Understanding Your Tax Questions About Residential Roof Replacements

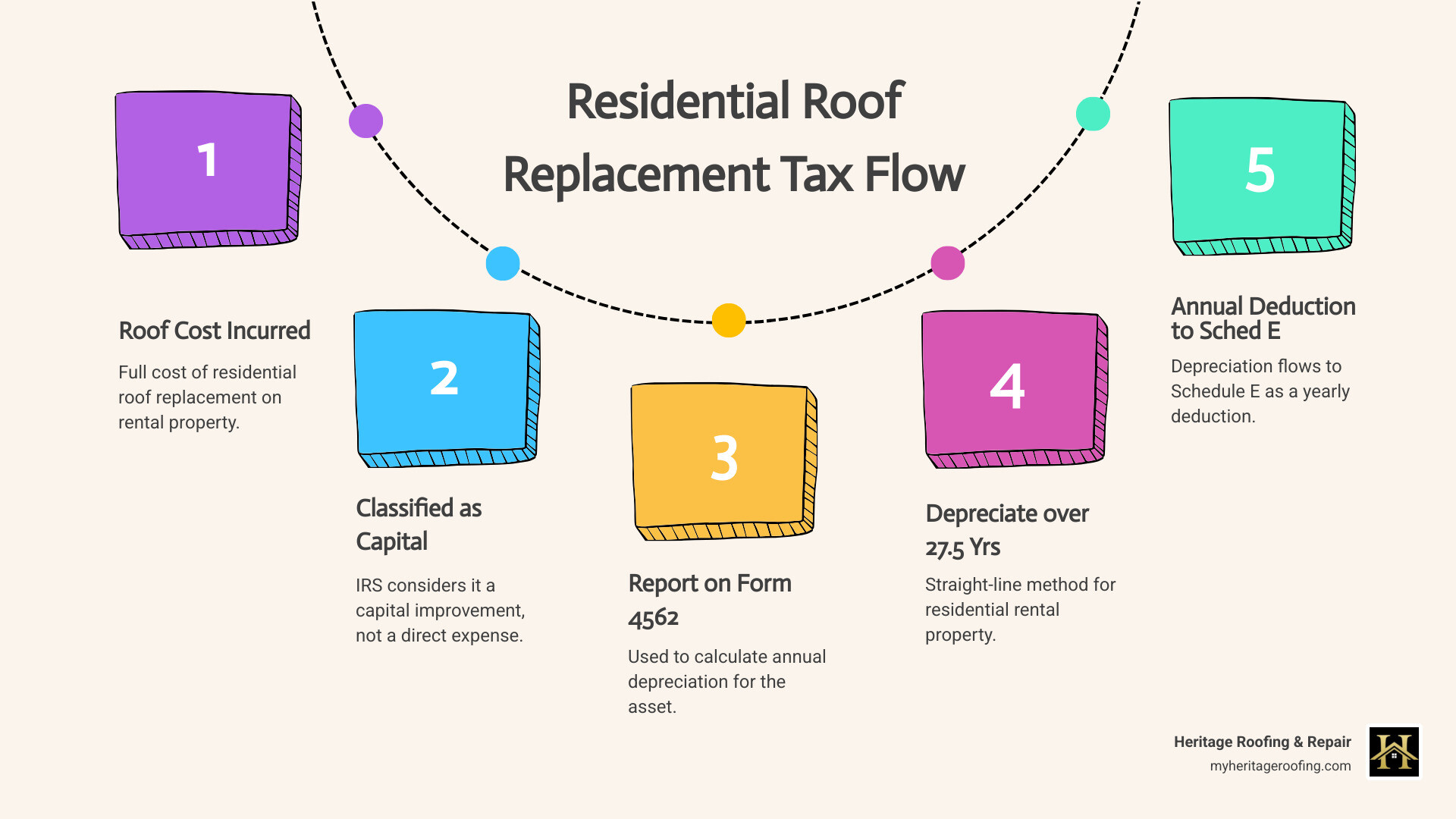

Which IRS Schedule E category is a residential roof replacement is a common question that catches many property owners off guard. The answer is straightforward but requires understanding how the IRS classifies different types of expenses:

Quick Answer:

- No direct Schedule E category exists for roof replacements

- Classified as a capital improvement, not an expense

- Reported through Form 4562 for depreciation

- Depreciated over 27.5 years for residential rental property

- Annual depreciation flows to Schedule E as a deduction

When you replace a roof on your rental property, you’re making what the IRS calls a capital improvement. This means you can’t deduct the full cost in the year you pay for it. Instead, you must depreciate the cost over 27.5 years using the straight-line method.

The confusion often stems from thinking of roof work as a repair expense. But according to IRS Publication 527, replacing an entire roof is considered a restoration that adds value and extends the property’s useful life. This makes it a capital improvement that must be capitalized and depreciated.

If you need a professional roof replacement that’s built to last and worth every depreciation deduction, Heritage Roofing & Repair has served Northwest Arkansas homeowners for over 50 years. As someone who’s helped countless property owners steer both roofing projects and the tax implications of which IRS Schedule E category is a residential roof replacement, I understand how important it is to get both the installation and the paperwork right.

Know your which irs schedule e category is a residential roof replacement terms:

Is a Roof Replacement a Repair or a Capital Improvement?

This is the million-dollar question that stumps many property owners when tax season rolls around! The distinction between a repair and a capital improvement isn’t just accounting jargon – it directly impacts how you handle which IRS Schedule E category is a residential roof replacement on your tax return.

Here’s the basic difference: A repair keeps your property in good working order without adding significant value or extending its life. Think patching a small leak, replacing a handful of shingles, or clearing debris from gutters. These routine maintenance costs can typically be deducted in the year you pay for them.

A capital improvement, however, adds value to your property, extends its useful life, or adapts it for a new purpose. When you replace an entire roof, you’re not just fixing a problem – you’re installing a major new component that will protect your investment for decades. This is why the IRS requires you to capitalize the expense and depreciate it over time.

The IRS explains this clearly in IRS Publication 527 for residential rental property. According to their Tangible Property Regulations, improvements must result in betterment, restoration, or adaptation of your property. A full roof replacement almost always qualifies as a restoration because you’re replacing a substantial structural component.

Here’s how to tell the difference:

| Characteristic | Simple Repair (Deductible Expense) | Capital Improvement (Capitalize) |

|---|---|---|

| Purpose | Maintain existing condition | Add value, extend life, adapt use |

| Scope of Work | Patching, minor fixes, routine upkeep | Full replacement, structural changes, upgrades |

| Impact on Value | No significant increase | Increases property value |

| Impact on Life | Does not extend useful life | Extended useful life |

| IRS Treatment | Deductible expense in current year | Depreciated over multiple years |

| Roofing Example | Patching leaks, replacing a few shingles | Full roof replacement, structural work |

When Does a Minor Repair Become a Major Capital Improvement?

The line between repair and improvement isn’t always crystal clear, but the IRS provides three specific tests to help you decide. Your roof work qualifies as a capital improvement if it meets any of these criteria:

Betterment means your expense fixes a major defect, increases the property’s capacity, or significantly improves its quality. If you’re upgrading from basic asphalt shingles to premium architectural shingles or a metal roof system, you’re making a betterment that increased property value and quality beyond the original installation.

Restoration involves replacing substantial structural parts, repairing major damage, or returning the property to like-new condition. This is where most roof replacements land. When you replace an entire roof system, you’re restoring a major building component. This is especially true for storm damage roof repair that requires extensive reconstruction.

Adaptation applies when you modify the property for a new or different use than its original purpose. While less common for standalone roof work, this might apply if you’re modifying the roof structure to accommodate a conversion project.

Most residential roof replacements qualify as restoration because they involve replacing a substantial structural part of the building and significantly extend the extended useful life of this critical building system.

How Do the Tangible Property Regulations Define an Improvement?

The Tangible Property Regulations get more specific about what constitutes an improvement. These rules introduce the concept of a Unit of Property (UoP) and building systems. For residential rental properties, your roof is considered one of several distinct building systems within your property.

The IRS defines improvements as expenses that pass one of three tests applied to these structural components. The betterment test asks whether your new roof materially increases the property’s value, strength, or capacity compared to the original installation.

The restoration test is where most roof replacements get classified as capital improvements. If you’re replacing major components of the roof system or returning it to efficient operating condition after significant deterioration, you’re making a restoration that must be capitalized.

The adaptation test determines whether you’ve modified the roof for a different use than originally intended. While this is less common for basic roof replacements, it might apply if your roofing project involves structural changes to accommodate new uses.

Understanding these regulations helps explain why which IRS Schedule E category is a residential roof replacement doesn’t have a simple answer – because roof replacements aren’t treated as regular expenses but as capital improvements that require special tax treatment.

Which IRS Schedule E Category Is a Residential Roof Replacement?

Here’s where things get interesting – and maybe a little frustrating if you’re looking for a simple answer. Which IRS Schedule E category is a residential roof replacement? Well, there isn’t one! You won’t find a neat little box labeled “roof replacement” anywhere on Schedule E.

That’s because Schedule E (Form 1040), Supplemental Income and Loss, is designed for reporting income and expenses from rental real estate, but capital improvements like roof replacements don’t work like regular expenses. They’re not something you can just write off in the year you pay for it.

Think of it this way: when you replace a roof, you’re not buying a consumable item like office supplies or paying for a service like lawn care. You’re making a major investment that will protect and add value to your property for decades. The IRS recognizes this and requires you to treat it as such.

Instead of being a direct expense on Schedule E, your new roof becomes a depreciable asset. This means you’ll spread the tax deduction over many years through depreciation. The process starts with Form 4562 (Depreciation and Amortization), and then the annual depreciation amount flows through to Schedule E as a deduction.

For expert guidance on making this investment worthwhile, our team at Heritage Roofing & Repair has been helping Arkansas property owners with quality residential roofing services for over 50 years.

How to Report a Roof Replacement on Your Tax Forms

The reporting process involves two main forms working together, and it’s actually more straightforward than it might seem at first glance.

Form 4562 is your starting point. This is where you’ll list your new roof as a depreciable asset in Part III (MACRS Depreciation). You’ll need to include the total cost, the date it was placed in service (usually when the work was completed), and specify the 27.5-year recovery period for residential rental property. The form does the math for you, calculating your depreciation deduction for the current tax year.

Schedule E is where the magic happens. Once Form 4562 calculates your annual depreciation amount, that number gets transferred to Schedule E, Part I, on the depreciation line (typically line 18, though this can vary by tax year). This is where your roof replacement finally shows up as a tax benefit – not as the full cost, but as the annual depreciation expense that reduces your taxable rental income.

The beauty of this system is that you get a tax benefit every year for 27.5 years, rather than a big deduction in just one year that might not even be useful if your rental income is low that particular year.

What if I Replaced Gutters and Windows at the Same Time?

Real life rarely happens in neat, isolated projects, does it? If you’re like many property owners, you probably tackled multiple improvements at once – maybe the roof, gutters, and windows all needed attention after a particularly rough storm season.

The good news is that the IRS has clear guidance for this situation. When you replace major components or substantial structural parts of your building simultaneously, these are all considered restoration work under the tangible property regulations. This means your roof, gutters, and window replacements all get the same tax treatment as capital improvements.

You can handle the costs as bundled project costs and capitalize them as a single improvement, or treat them as separate assets that all follow the same 27.5-year depreciation schedule. Either way, you’re looking at the same recovery period and the same basic process through Form 4562.

The IRS specifically addresses this scenario in their rules on capitalization, recognizing that comprehensive exterior work represents a major restoration of the property rather than routine maintenance.

This bundled approach makes sense when you think about it – if you’re doing extensive work on multiple building systems at once, you’re clearly making a substantial investment in restoring and improving the property, not just patching up minor issues.

How to Depreciate a New Roof on a Rental Property

Once you’ve established that your residential roof replacement is a capital improvement, the next step is understanding how to depreciate it properly. The IRS requires you to use something called the Modified Accelerated Cost Recovery System (MACRS) for most property placed in service after 1986. Don’t worry – it sounds more complicated than it actually is!

For residential rental property, you’ll use the General Depreciation System (GDS) with the straight-line method. This simply means you deduct the same amount each year over the asset’s recovery period. It’s predictable and straightforward – no fancy calculations or changing amounts from year to year.

The key concept here is the recovery period – that’s the number of years over which you can spread out your deduction. For residential rental property improvements like your new roof, this is always 27.5 years. Every property owner gets the same timeframe, regardless of the actual roof material or expected lifespan.

There’s also something called the mid-month convention that affects your first and last years of depreciation. Basically, the IRS treats any asset as if it was placed in service in the middle of whatever month you actually completed it. So if your roof was finished in August, you’d get credit for 4.5 months of depreciation in that first year (half of August plus September through December).

The IRS covers all the technical details in IRS Publication 946, which is your go-to resource for understanding property depreciation rules.

What is the Recovery Period for a Residential Roof Replacement?

When it comes to which IRS Schedule E category is a residential roof replacement, the roof itself gets depreciated over exactly 27.5 years. This isn’t negotiable or variable – it’s the standard recovery period for all residential rental property under the General Depreciation System.

The IRS chose 27.5 years because it represents their estimate of the useful life of residential rental property improvements. Whether you installed basic asphalt shingles or premium metal roofing, the depreciation timeline stays the same. The tax code doesn’t distinguish between different roofing materials when it comes to the recovery period.

Using the straight-line method makes the math simple. You take your total roof cost and divide by 27.5 to get your annual deduction. If your roof cost $27,500, you’d deduct exactly $1,000 each year for 27.5 years. That annual deduction flows from Form 4562 to your Schedule E, reducing your taxable rental income year after year.

This is quite different from a simple repair, where you might have a smaller roof repair cost that you can deduct entirely in the current tax year. The capital improvement approach spreads the tax benefit over the long term, matching the extended value your new roof provides.

Calculating Your Annual Depreciation Deduction

Let’s walk through a real-world example to show how the depreciation calculation works. The process starts with determining your cost basis – that’s the total amount you invested in the new roof.

Your cost basis includes everything: the roofing materials, labor costs, permits, disposal of the old roof, and any other direct expenses related to the installation. Let’s say your complete roof replacement cost $40,000.

Next, you apply the 27.5-year recovery period for residential rental property. Your basic annual depreciation would be $40,000 divided by 27.5 years, which equals $1,454.55 per year. This is the amount you’d deduct in each full year after the first year.

The first-year calculation gets a bit more interesting because of the mid-month convention. If your roof was completed and your rental property was ready for tenants in August, you’d calculate like this: You get depreciation credit for 4.5 months (half of August plus September through December). Take your annual depreciation of $1,454.55, divide by 12 months, then multiply by 4.5 months. That gives you $545.45 for your first year.

In the final year of depreciation (year 28), you’d claim the remaining months to complete the full 27.5 years. Most tax software handles these calculations automatically once you enter the cost and the placed-in-service date, but understanding the logic helps you verify the numbers and keep better records.

The key is maintaining excellent documentation of all costs and dates, since these figures directly support your annual deductions on Schedule E for nearly three decades!

Documentation and Special Considerations for Your Roof Replacement

When it comes to taxes, the IRS loves paperwork almost as much as they love collecting revenue. For a significant capital improvement like a residential roof replacement, keeping excellent records isn’t just smart—it’s absolutely essential. Think of documentation as your financial insurance policy that protects your depreciation deductions for years to come.

We know that dealing with tax paperwork can feel as overwhelming as navigating a roof insurance claim, but with the right approach, you’ll have everything organized and audit-ready.

What Documentation Do I Need to Support My Deduction?

The golden rule of tax deductions is simple: if you can’t prove it, you can’t deduct it. For your roof replacement, you’ll need to create a comprehensive paper trail that tells the complete story of your capital improvement.

Start with your contractor invoices—these should show detailed breakdowns of materials, labor costs, and the total project scope. Don’t settle for a simple “roof replacement – $25,000” receipt. You want invoices that clearly describe what work was performed and when it was completed.

Keep all your material receipts if you purchased any supplies separately. Your proof of payment is equally important—cancelled checks, bank statements, credit card records, or electronic payment confirmations all work perfectly.

Building permits serve double duty as both proof of work and evidence of the completion date. Many municipalities require permits for major roof work, and these documents often include inspection records that support the capital improvement classification.

Before-and-after photos might seem obvious, but they’re incredibly valuable. They visually document the change from old to new, supporting your claim that this was indeed a restoration or betterment. Take wide shots showing the entire roof, close-ups of problem areas, and detailed images of the finished work.

Don’t forget about inspection reports from your contractor or building inspector, and if you financed the project, keep all your loan documents as additional proof of the investment amount.

Store these records safely for at least the entire 27.5-year depreciation period plus three additional years. That’s a long time, so consider digital copies stored in multiple locations.

Does the Routine Maintenance Safe Harbor Apply?

Here’s where some property owners get their hopes up, thinking they might find a shortcut around the capital improvement rules. The routine maintenance safe harbor sounds promising—it allows certain maintenance costs to be deducted immediately rather than capitalized and depreciated.

Unfortunately, this safe harbor rarely applies to full roof replacements. The provision is designed for truly routine maintenance that you’d expect to perform multiple times during a property’s life—think annual HVAC tune-ups, regular gutter cleaning, or periodic exterior painting.

A complete roof replacement is the opposite of routine maintenance. It’s a major undertaking that typically happens once every 20-30 years and significantly extends your property’s useful life. The IRS specifically designed the safe harbor for smaller, recurring expenses, not substantial structural improvements.

Even the small taxpayer safe harbor found in IRS Publication 535 has strict limitations. You must have average annual gross receipts of $10 million or less, and your total building improvements can’t exceed the lesser of $10,000 or 2% of the building’s unadjusted basis. Most roof replacements blow right past these thresholds.

The bottom line? Don’t count on the routine maintenance safe harbor to help you expense your roof replacement. Plan on capitalizing the cost and depreciating it over 27.5 years.

Work with a Local Pro Who Understands Arkansas Homes

Getting your roof replacement right—both the installation and the tax treatment—starts with choosing the right contractor. When you need a professional roof replacement estimate from a team that understands both quality craftsmanship and proper documentation, we’re here to help.

At Heritage Roofing & Repair, we’ve spent over 50 years perfecting our craft and helping Northwest Arkansas homeowners protect their most important investment. We know that which IRS Schedule E category is a residential roof replacement matters to property owners, which is why we provide detailed invoices and documentation that make your tax filing straightforward.

Our experienced team serves Berryville, Harrison, Fayetteville, and the surrounding areas with dependable, affordable roofing solutions. Whether you’re dealing with storm damage or planning a proactive replacement, we’ll ensure your project is completed to the highest standards and properly documented for tax purposes.

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

(870) 654-1164

Conclusion

After diving deep into the tax complexities, the answer to which IRS Schedule E category is a residential roof replacement becomes crystal clear: there isn’t one! It’s a bit like asking which grocery aisle sells houses – you’re looking in the wrong place entirely.

Your residential roof replacement isn’t a simple expense that gets its own line on Schedule E. Instead, it’s what the IRS considers a capital improvement that adds genuine, long-term value to your rental property. This means you’ll be depreciating that investment over 27.5 years, spreading the tax benefits across nearly three decades.

The process itself is straightforward once you understand it. You’ll use Form 4562 to calculate your annual depreciation deduction, then transfer that amount to Schedule E where it reduces your taxable rental income year after year. It’s actually a pretty fair system – you get tax benefits for as long as that roof protects your investment.

The key to success lies in proper classification and documentation. Keep every receipt, invoice, permit, and photo related to your roof replacement. These records aren’t just helpful – they’re essential if the IRS ever has questions about your deduction.

When you’re ready for a roof replacement that’s built to last and worth every depreciation deduction you’ll claim, Heritage Roofing & Repair brings over 50 years of trusted craftsmanship to Northwest Arkansas. We understand that a quality installation isn’t just about protecting your property today – it’s about creating lasting value that justifies the capital improvement classification.

Contact us today to learn more about our roof replacement services and get started on an investment that will benefit both your property and your tax situation for years to come.