Understanding Metal Roof Hail Damage and Insurance Claims

After a hailstorm, the dents on your metal roof raise an urgent question: will insurance cover the damage? While metal roofs are exceptionally durable, they aren’t immune to hail. Navigating a claim can be complex, as insurers have specific definitions for what constitutes “damage,” and coverage often hinges on the fine print of your policy. For homeowners in Northwest Arkansas, understanding this process is the first step in protecting your home with expert roofing services. This guide clarifies the key factors, helping you prepare for a successful claim.

With over 50 years of experience, Heritage Roofing & Repair has helped countless homeowners in Berryville, Fayetteville, and Harrison secure fair settlements for metal roof hail damage insurance claims.

What is ‘Hail Damage’ on a Metal Roof? The Insurance Perspective

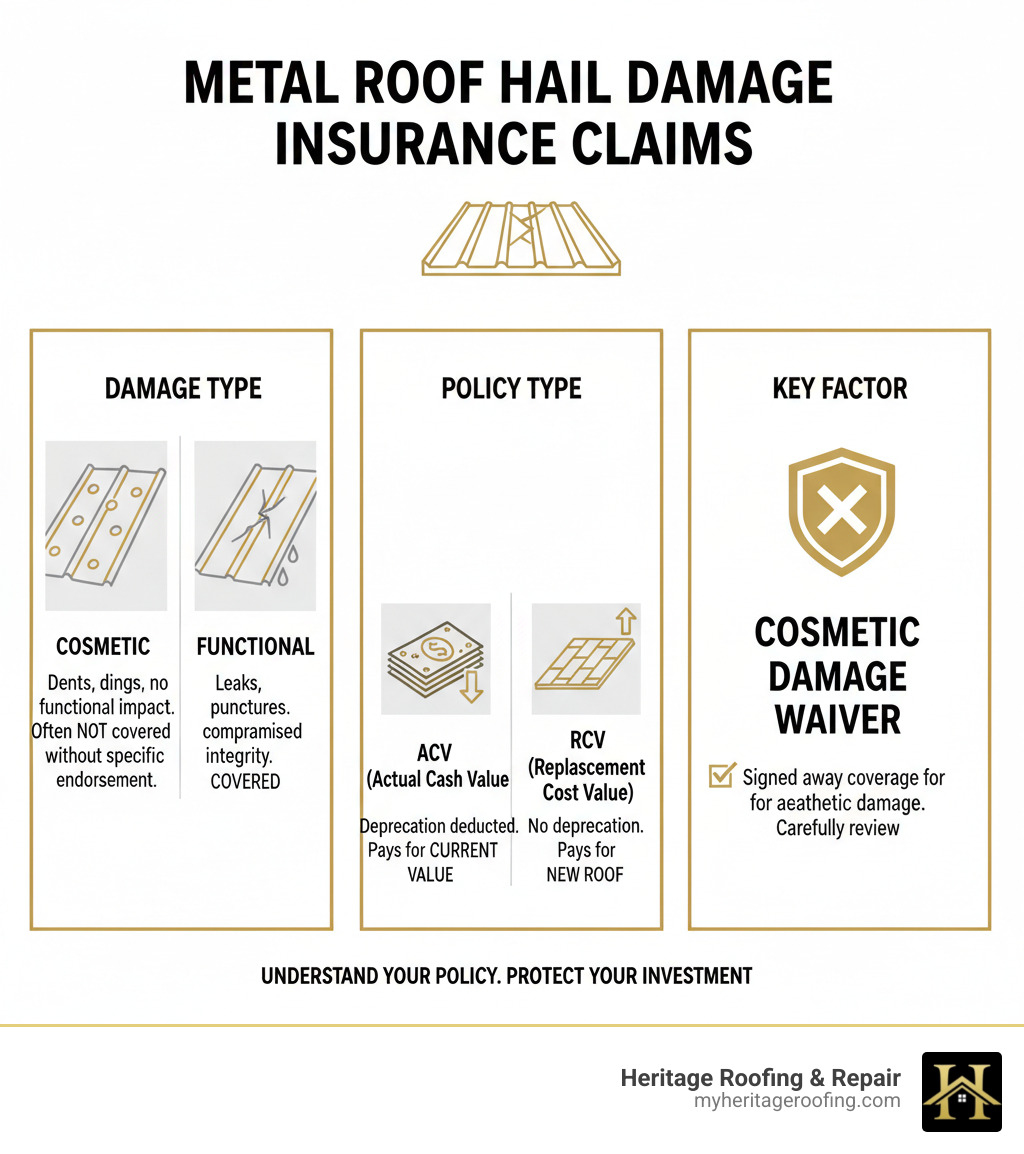

For insurance purposes, hail damage to a metal roof is categorized as either functional or cosmetic. This distinction is the central point of most metal roof hail damage insurance claims and determines whether a payout is approved.

Functional vs. Cosmetic Damage: The Core of the Debate

Understanding the difference is critical for your claim.

Functional damage is any impact that compromises the roof’s ability to protect your home or shortens its expected service life. This is almost always covered by insurance. Examples include:

- Punctures: Holes or tears in the metal panels that allow water intrusion.

- Broken Seams: Damage to interlocking seams on a standing seam roof, creating a direct path for leaks.

- Compromised Water-Shedding: Severe dents that cause water to pool instead of shedding, leading to accelerated wear.

- Reduced Service Life: Damage, such as cracking of the protective coating, that will lead to premature failure like rusting.

Cosmetic damage refers to aesthetic issues that do not immediately affect the roof’s performance, such as dents and dings. Many insurance policies, especially those with cosmetic damage waivers, will not cover this. However, what an adjuster calls “cosmetic” can often lead to functional problems over time.

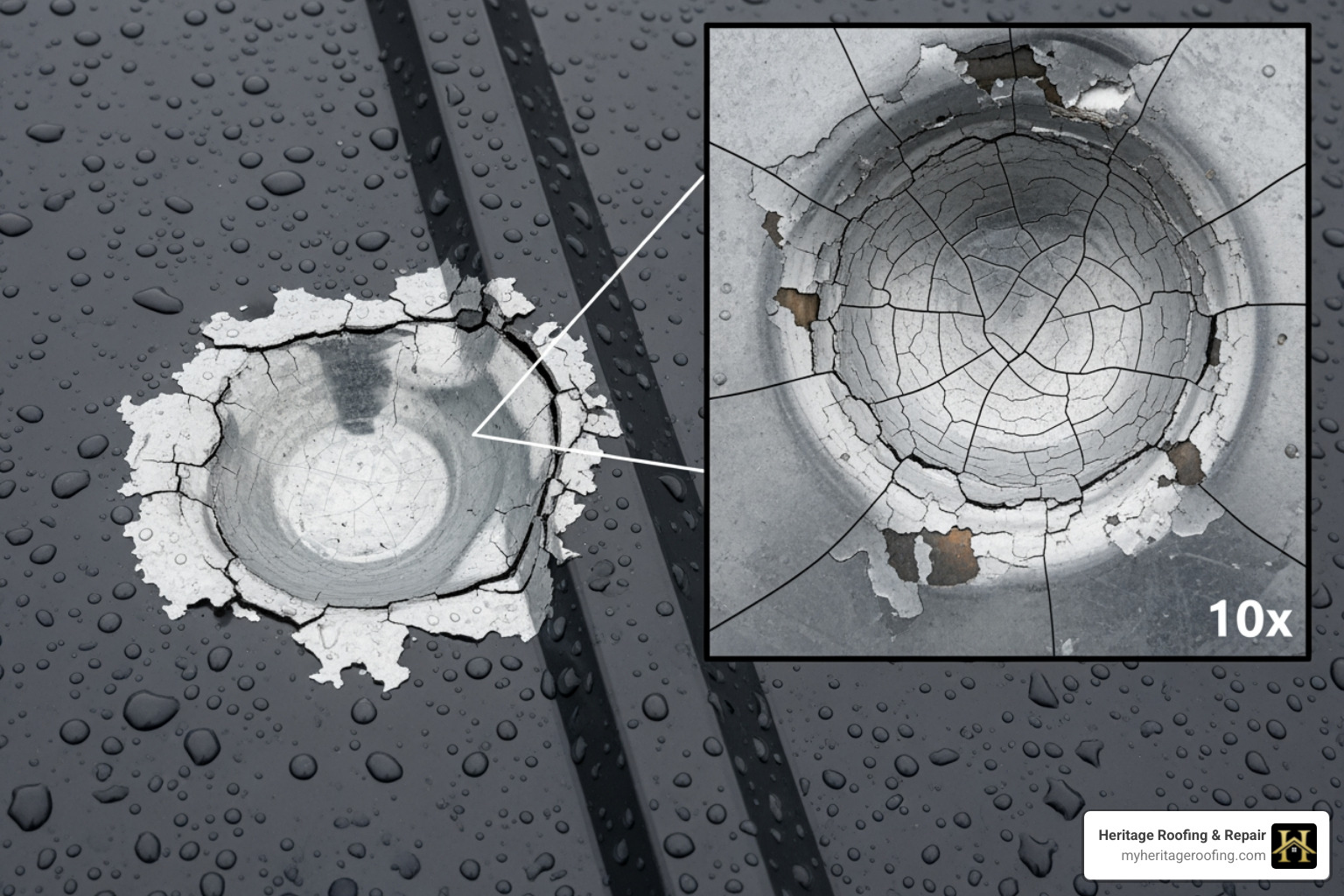

The Hidden Dangers of “Cosmetic” Damage

A dent that appears merely cosmetic can conceal long-term threats to your roof’s integrity. This is a key argument in any metal roof hail damage insurance claim.

- Micro-fracturing: The force of a hail impact can create microscopic cracks in the roof’s protective coating (e.g., paint, Galvalume). These are invisible to the naked eye but expose the underlying metal.

- Coating Compromise & Rust: Once the coating is breached, moisture and oxygen cause rust and corrosion. Over time, this weakens the metal panel.

- Voided Manufacturer Warranties: Many roofing warranties are voided by damage from hail. If the “cosmetic” damage leads to rust years later, the manufacturer may not cover the failure, leaving you with the bill.

- Future Leaks: A dent that doesn’t leak today can become a hole tomorrow. The corrosion process that starts in a small crack can eventually perforate the metal, causing a leak years after the storm.

The long-term consequences of seemingly minor dents are a primary reason to challenge a “cosmetic damage” ruling. To learn more about identifying hail damage, see our Hail Damage Roof Guide 2025.

Will Insurance Pay? Key Policy Factors That Determine Your Payout

Whether your insurance will pay for hail damage to your metal roof depends entirely on the fine print of your policy. Several factors, from your coverage type to specific exclusions, dictate the outcome of your claim.

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

The difference between ACV and RCV coverage is the most significant factor in your payout. This distinction can mean a difference of thousands of dollars.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Pays the cost to replace the damaged item minus depreciation. | Pays the full cost to replace the damaged item with a new one of similar kind and quality. |

| Payout Calculation | Replacement Cost – Depreciation = Payout | Full Replacement Cost = Payout (usually paid in two installments) |

| Best For | Lower premiums, older roofs/materials. | Comprehensive protection, ensuring a new roof without out-of-pocket depreciation costs. |

An ACV policy pays for the depreciated value of your roof. If a 20-year roof is 10 years old, the insurance payout will be roughly half the cost of a new one, minus your deductible. An RCV policy pays the full cost to install a new roof of similar quality, without deducting for age. For a significant investment like a metal roof, RCV coverage is strongly recommended. Be aware that some policies automatically switch from RCV to ACV after a roof reaches a certain age. For more common insurance terms, you can always refer to the NAIC consumer glossary.

Understanding Waivers and Deductibles

Two other policy elements that heavily influence your out-of-pocket costs are waivers and deductibles.

- Cosmetic Damage Waiver: This is an endorsement that excludes coverage for aesthetic damage, like dents, that doesn’t cause a functional problem. While it lowers your premium, signing this waiver in a hail-prone area like Northwest Arkansas is risky. It could leave you with a functional but heavily dented roof that you cannot get repaired through insurance.

- Wind and Hail Deductibles: These are often separate from your standard deductible and are frequently percentage-based (e.g., 1-2% of your home’s insured value). For a $300,000 home, a 2% deductible means you pay the first $6,000. Always confirm this amount in your policy. For more details, see our guide on Homeowners Insurance Roof Damage.

How Your Roof’s Specifications Influence Coverage

The type of metal roof you have affects both its durability and how an insurance claim is assessed.

- Metal Type and Gauge: Steel is tougher than aluminum, and a lower gauge number means thicker, more dent-resistant metal (e.g., 24-gauge is stronger than 29-gauge).

- Panel Profile: Standing seam profiles and ribbed panels can distribute impacts and hide minor dents better than flat panels.

- Paint Finish: Matte and textured finishes are better at disguising small dimples than glossy finishes.

Choosing the right materials from the start is a proactive step. Learn more about your options on our Metal Roofing page.

The Role of Industry Standards in Your Metal Roof Hail Damage Insurance Claim

Insurance adjusters rely on established industry standards to assess damage. Citing these standards in your metal roof hail damage insurance claim provides objective evidence that can strengthen your case, especially when challenging a “cosmetic only” ruling.

What is the UL 2218 Impact Resistance Test?

The UL 2218 Standard for Impact Resistance of Prepared Roof Covering Materials is the industry’s benchmark for testing a roof’s ability to withstand hail. The test involves dropping steel balls of various sizes from specific heights to simulate hailstone impacts.

Materials are given a rating from Class 1 (least resistant) to Class 4 (most resistant). To achieve a Class 4 rating, a roofing material must withstand a 2-inch steel ball dropped from 20 feet without cracking or tearing. A Class 4-rated metal roof is certified to resist severe impacts, and many insurers offer premium discounts for them. You can find technical details in the UL 2218 Standard for Impact Resistance catalog.

Using UL 2218 in Your Claim

Your roof’s UL 2218 rating is a powerful negotiating tool. Here’s how to use it:

- Provide Objective Proof: A Class 4 rating is independent, lab-verified proof that your roof was engineered to resist severe hail. If it’s damaged, it indicates the storm was unusually severe, overcoming its designed protections.

- Contest “Cosmetic” Rulings: If an adjuster dismisses dents on a Class 4 roof as “cosmetic,” you can argue that damage to such a highly-rated product warrants a more thorough functional assessment. The damage signifies an impact that exceeded the material’s certified resistance level.

- Demonstrate Expected Performance: A high rating implies a certain level of performance and durability that your insurer recognized when issuing the policy. Damage to a Class 4 product shifts the conversation from aesthetics to a failure of expected performance and long-term value.

Our team uses this technical expertise to help homeowners in Northwest Arkansas build strong cases. For more on this, review our guide on Insurance Roof Claims.

Step-by-Step Guide to Filing Your Claim in Arkansas

Knowing the correct steps to take after a hailstorm in Northwest Arkansas can be the difference between a denied claim and a full payout. Follow this roadmap for a successful metal roof hail damage insurance claim.

Step 1: Immediate Action and Thorough Documentation

The hours after a storm are critical.

- Safety First: Do not climb on a wet or potentially unstable roof. Inspect for damage from the ground.

- Document Everything: Note the date and time of the storm. Take date-stamped photos of dents from multiple angles, hailstones next to a ruler for scale, and any damage to gutters, siding, or windows.

- Gather Evidence: Obtain official weather reports to confirm a severe weather event occurred.

Step 2: Contacting a Professional and Filing the Claim

Once you have initial documentation, bring in an expert and notify your insurer.

- Hire a Reputable Roofer: A professional inspection is essential. At Heritage Roofing & Repair, we provide free, detailed inspections, identifying damage adjusters often miss, like micro-fractures. Our report becomes a cornerstone of your claim.

- File Your Claim Promptly: Contact your insurance company immediately to avoid missing filing deadlines. Have your policy number ready and be sure to get a claim number for all future correspondence.

For expert help and easy scheduling, you can reach us here:

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

(870) 654-1164

For more guidance, visit our page on filing a Roof Insurance Claim.

Step 3: The Adjuster Inspection and Negotiation in Berryville

Your preparation culminates in the adjuster’s visit.

- Be Present for the Inspection: Meet the adjuster to point out all areas of concern and provide your documentation, including our professional inspection report.

- Advocate for Your Claim: Explain the long-term consequences of “cosmetic” damage, such as rust and voided warranties. Ensure the adjuster’s report accurately reflects all damage.

- Negotiate the Settlement: If the initial offer is too low or dismisses legitimate damage, don’t accept it. Use your professional inspection report and industry standards like UL 2218 to negotiate a fair settlement. This is where our 50+ years of experience advocating for homeowners in Berryville and across Northwest Arkansas becomes invaluable.

If you need an expert on your side, our team is here to help.

Protecting Your Investment: Proactive Steps & When to Get Help

A denied or underpaid metal roof hail damage insurance claim is not the final word. Knowing your options before and after a storm is crucial for protecting your investment.

How to Ensure You Have Adequate Coverage Before a Storm

The best defense is a good offense. Prepare your policy before you need to file a claim.

- Review Your Policy Annually: Sit down with your agent each year to review your coverage. Policies change, and you need to know what is and isn’t covered.

- Reject Cosmetic Damage Waivers: In hail-prone areas, the premium savings for this waiver are rarely worth the risk of an uncovered claim for dents.

- Confirm RCV, Not ACV, Coverage: Ensure your policy provides Replacement Cost Value (RCV) for a full replacement, not the depreciated Actual Cash Value (ACV).

- Choose Impact-Resistant Materials: When installing a new roof, select Class 4 impact-resistant materials for superior protection and potential insurance discounts. Learn more in our Residential Metal Roof Replacement Guide 2025.

What to Do If Your Claim is Denied or Underpaid

If your claim is denied or the offer is too low, you have recourse.

- Request a Written Explanation: Demand a detailed, written reason for the denial. Compare it against your professional roofer’s inspection report.

- Get a Second Opinion: Ask for a different adjuster to inspect the property. We can help provide additional documentation to support your case.

- Hire a Public Adjuster: A public adjuster works for you, not the insurance company, to evaluate damage and negotiate a fair settlement.

- Consult an Insurance Lawyer: If you suspect bad faith (unreasonable delays, misrepresentation of your policy), a lawyer can help hold the insurer accountable.

- Use the Formal Appeals Process: Follow your policy’s appeals process precisely, submitting all documentation and clearly arguing your case.

For more on handling denied claims, explore our Homeowners Insurance Roof Damage Claim Guide.

Conclusion

Successfully navigating a metal roof hail damage insurance claim is about protecting your investment. The key is understanding that “cosmetic” dents can hide functional threats like micro-fractures and future corrosion. A successful claim depends on your policy details (RCV vs. ACV), thorough documentation, and a professional inspection report.

Don’t let an insurer’s initial assessment determine the fate of your roof. By understanding the difference between functional and cosmetic damage, citing industry standards like UL 2218, and being prepared to negotiate, you can advocate for the full compensation you deserve.

If you’re in Berryville, Fayetteville, Harrison, or anywhere in Northwest Arkansas and feel overwhelmed by the claims process, you don’t have to go it alone. Heritage Roofing & Repair has over 50 years of experience helping homeowners secure fair settlements. We provide the expert documentation and advocacy needed to protect your home.

For a complete overview, explore our ultimate guide to roofing insurance claims. When you’re ready to file your claim, our team is here to help.