Your Roof, Your Rights: What to Do When Your Hail Damage Claim Gets Denied

Hail damage roof claim denied? You’re not alone. Approximately 37% of property insurance claims are rejected nationwide. With residential roof claims surging to $31 billion in 2024, insurers are scrutinizing every case more carefully than ever. A denial isn’t the final word; it’s a signal to take strategic action. With the right strategy and help from a dependable local roofing company, you can effectively challenge the decision and protect your home.

I’m Rex Wisdom, owner of Heritage Roofing & Repair. For over 50 years, our family has helped hundreds of Arkansas homeowners successfully appeal denied storm damage claims. I’ve seen how a hail damage roof claim denied can be overturned with the right documentation and expert support.

Why Insurers Deny Hail Damage Claims (And What They Don’t Tell You)

You filed a claim after a hailstorm, confident your insurance would cover the damage. Then the denial letter arrived. Understanding why insurers deny claims—and what they’re not telling you—is your first step in fighting back.

The most common reasons for a hail damage roof claim denied include:

- Insufficient Evidence: The adjuster claims they didn’t find enough verifiable hail damage. This is increasingly common as insurers scrutinize claims more aggressively.

- Pre-existing Damage or Poor Maintenance: Insurers argue damage is from an old roof or wear and tear, not the storm. They know 38% of U.S. homes have roofs in moderate to poor condition and use this statistic to attribute new damage to old issues.

- Policy Exclusions: Your policy might exclude “cosmetic damage” or have high deductibles that make a claim less appealing for the insurer to pay.

- Late Filing: Most policies require claims to be filed “as soon as practicable.” Waiting too long gives them an easy reason to deny.

- Improper Documentation: A lack of thorough photos, reports, or accurate dates gives the insurer grounds for rejection.

Insurers may also dispute the cause of damage, contending it came from something other than hail. For more on industry trends, see the Verisk 2024 roof claims report.

Understanding “Cosmetic Damage” and Other Policy Loopholes

One of the most common tactics to deny a claim involves the term “cosmetic damage.” This exclusion states insurers won’t pay for damage affecting only your roof’s appearance—like small dents—if it doesn’t impair the roof’s function. The catch: what an insurer calls “cosmetic” can lead to future problems like rust or accelerated weathering. Similarly, marring exclusions for surface imperfections are often deliberately vague.

The real battle is over functional damage (affects performance) versus aesthetic damage (affects appearance). While insurers aim to cover only functional damage, courts have often ruled that unless explicitly excluded, cosmetic damage can still be a direct physical loss if it reduces your roof’s lifespan or value. This ambiguity creates an opportunity for you to challenge a denial. If hail impacted your roof, the damage likely goes deeper than the surface. More info about hail damage can help you identify the real signs.

ACV vs. Replacement Cost: How Your Policy Type Affects Your Payout

The type of coverage you have—Actual Cash Value (ACV) or Replacement Cost Value (RCV)—dramatically impacts your payout.

- Actual Cash Value (ACV) policies pay the depreciated value of your roof, factoring in age and wear. If your 15-year-old roof is damaged, an ACV policy pays only a fraction of the replacement cost, leaving you with a large bill.

- Replacement Cost Value (RCV) is the superior coverage. It pays the full cost to replace your damaged roof with a new one of similar quality, without deducting for depreciation. You typically get an initial ACV payment, then the rest after work is complete.

Percentage deductibles further complicate matters. Instead of a flat $1,000, many policies in hail-prone areas have deductibles of 1-5% of your home’s insured value. On a $200,000 home with a 2% deductible, you’d pay the first $4,000 of a roof replacement. Understanding these details is critical when challenging a denial.

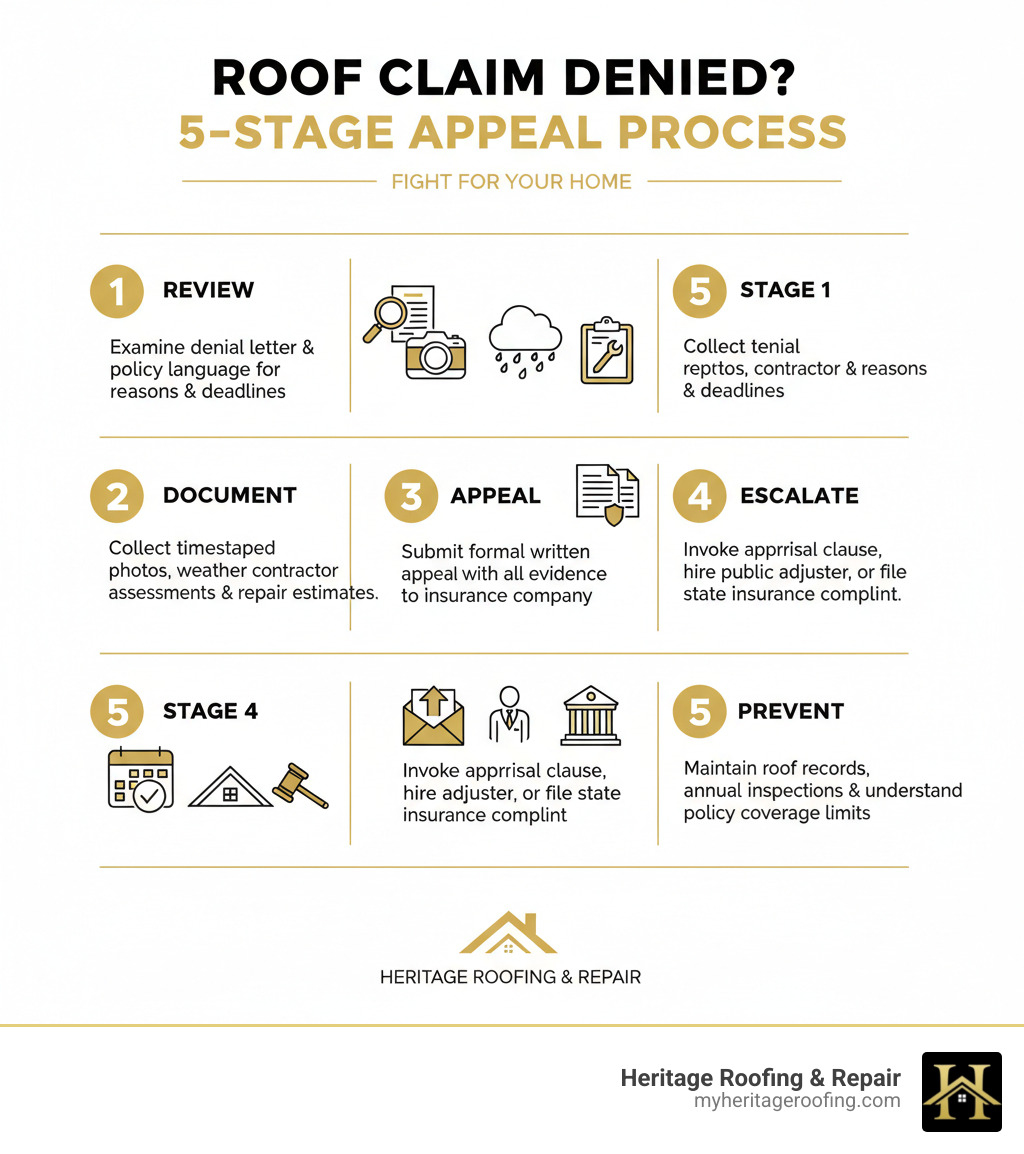

Your Immediate 4-Step Action Plan After a Denial

A denial letter is the insurance company’s opening position, not the final word. The moment you receive it, the clock starts on your appeal. Taking organized, immediate action is your most powerful tool.

Step 1: Scrutinize the Denial Letter and Your Policy

Read the denial letter and your policy carefully. The letter must state why your claim was rejected—whether for “no functional damage,” “pre-existing conditions,” or another reason. Cross-reference this with your policy, noting the specific clauses, coverage limits, and exclusions they cite. Most importantly, find and highlight any deadlines for appeal, as missing them can end your claim permanently.

Step 2: Gather Overwhelming Evidence

Build a case that buries them in facts. The insurer’s adjuster took photos; now you need to do the same, but better.

- New Photos and Videos: Use your smartphone to document all damage in high resolution. Timestamps are automatic and provide powerful proof.

- Weather Reports: Obtain official weather data for your address on the storm date to confirm hail size and intensity.

- Contractor Estimates: Get written estimates from roofing contractors detailing the full scope and cost of repairs. This quantifies your loss and makes it harder for the insurer to lowball you.

Step 3: Get an Independent Roof Inspection

The insurance adjuster works for the insurer, not you. You need an independent expert on your side. Contact a trusted local roofing contractor with experience in insurance claims, especially one familiar with the weather patterns in Northwest Arkansas.

At Heritage Roofing & Repair, we know what adjusters look for—and what they often overlook. Your contractor should provide a detailed damage report that distinguishes new hail damage from pre-existing conditions and explains why the damage is functional, not just cosmetic. A professional repair estimate should include all costs for materials, labor, and required code upgrades.

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

Click to Call: (870) 654-1164

Step 4: Draft Your Formal Appeal Letter

Your appeal is a formal, written communication. It should be professional and evidence-based.

- State your disagreement clearly at the top, including your policy and claim numbers.

- Reference your policy to support your position and counter their reasoning.

- Attach all new evidence and explain how it contradicts the adjuster’s findings.

- Request a second inspection from a different adjuster. This is your right as a policyholder.

With these four steps, you transform a hail damage roof claim denied from a dead end into a winnable fight.

How to Effectively Appeal a Denied Hail Damage Roof Claim

The appeals process is your formal opportunity to present new evidence and force the insurer to reconsider. While approximately 37% of property claims are initially denied, many are reversed when homeowners fight back with a documented, professional strategy. Insurance companies often count on you to give up; responding with compelling evidence shifts the dynamic.

The Crucial Role of a Roofing Contractor in Your Appeal

When appealing a hail damage roof claim denied, a roofing contractor is your most powerful advocate. At Heritage Roofing & Repair, we’ve found that having a knowledgeable contractor in your corner changes everything.

An expert provides a damage assessment that goes beyond what a typical adjuster sees, spotting subtle functional damage. Meeting the adjuster on-site is critical. We can point out specific damage in real-time, explaining why it compromises your roof’s integrity. We back up our findings with meteorological reports and manufacturer specifications, showing what constitutes damage for your specific roofing material. Our accurate scope of work ensures all necessary repairs, including code upgrades, are accounted for, preventing the insurer from underpaying your claim. Learn more about storm damage roof repair and how we can assist with your claim.

What to Do When Your Hail Damage Roof Claim is Denied Again

If your initial appeal is denied, don’t give up. You have several powerful options:

- Request a New Adjuster: A fresh pair of eyes can make all the difference, especially if the first adjuster was inexperienced or biased.

- Invoke the Appraisal Clause: Most policies contain this clause, which lets you and the insurer hire independent appraisers to determine the amount of loss. Their binding decision can resolve disputes over the cost of damage.

- Try Mediation: A neutral third party helps you and the insurer negotiate a settlement. This is often faster and less expensive than court.

- File a Complaint: Filing a complaint with the Arkansas Department of Insurance signals you are serious and invites regulatory scrutiny of the insurer’s actions.

When writing your appeal, use clear, powerful language. Here are key phrases to include:

- To start your letter: “I formally dispute the denial of my claim [Claim Number] based on the following evidence…”

- To counter a common denial: *”The damage observed is functional, compromising the roof’s ability to shed water, not merely cosmetic.”

- To request action: *”I request a re-inspection by a different adjuster with specialized expertise in hail damage assessment.”

- To escalate a cost dispute: *”I refer to the appraisal clause in my policy, Section [Policy Section Number], and intend to invoke it to resolve this dispute.”

- To demand justification: “Please provide all documentation supporting your assertion that the damage is due to wear and tear, rather than the hailstorm on [Date].”

When to Escalate: Hiring a Public Adjuster or Attorney

When your best efforts and your contractor’s help aren’t enough, it’s time to escalate. If the insurance company still won’t approve your hail damage roof claim denied, professional advocates can level the playing field. They know the industry’s tactics and how to push back effectively. The key is knowing who to hire and when.

Public Adjuster vs. Attorney: Who to Hire and When

The choice between a public adjuster and an attorney depends on the nature of your dispute.

| Professional | When to Hire | Primary Role |

|---|---|---|

| Public Adjuster | The dispute is over the scope and cost of damage. | Assesses damage, documents the claim, and negotiates with the insurer for the maximum payout. Works on a percentage of the settlement. |

| Attorney | The dispute is legal in nature, involves bad faith, or you need to file a lawsuit. | Represents you in legal proceedings, challenges unfair practices, and can sue the insurer. Typically works on a contingency fee. |

In short, hire a public adjuster for negotiation help and an attorney when the fight turns legal.

Recognizing and Fighting Bad Faith Insurance Practices

Insurance companies have a legal duty to handle your claim in good faith. When they don’t, it’s called “bad faith.” Signs of bad faith include:

- Unreasonable delays in processing your claim.

- Refusing to provide a clear, written reason for a denial.

- Offering a lowball settlement that is obviously insufficient.

- Misrepresenting your policy coverage to avoid paying.

If you suspect bad faith, document everything—every email, letter, and phone call. Then, take action by filing a formal complaint with the Arkansas Insurance Department, which investigates consumer complaints against insurers. Consulting an attorney specializing in insurance bad faith can also clarify your legal options, which may include damages beyond the original claim amount.