Why Understanding Roofing Insurance Claims Can Save You Thousands

Filing roofing insurance claims after storm damage can be a stressful and confusing experience for any homeowner. Understanding the process is critical, as mistakes can lead to denied claims or payouts that fall short of the actual repair cost. With home insurance companies paying an average of $13,000 for wind and hail claims, knowing how to steer the system can save you thousands. For homeowners in Northwest Arkansas, having a trusted local expert is essential. At trusted Northwest Arkansas roofing company, we’ve spent over 50 years helping our neighbors manage their claims successfully.

This guide will walk you through the key steps, from documenting damage and reviewing your policy to working with an adjuster and choosing a reputable contractor. We’ll cover what’s typically included (wind, hail, fallen trees) and what’s not (wear and tear, poor maintenance). With an experienced contractor advocating for you, you can turn a potential headache into a smooth, successful restoration of your home’s most important protection.

First 48 Hours: Identifying Damage & Understanding Your Policy

Before you contact your insurance company, assess the damage and understand your policy. Acting without this information is a common mistake that can jeopardize your claim. These first steps will build a strong foundation for a successful outcome.

What is Covered? Common Perils in Homeowners Insurance

Most standard homeowners insurance policies cover damage from sudden, unexpected events, often called “perils.” This typically includes:

- Wind and Hail: The most frequent cause of roof claims. Strong winds can tear off shingles, while hail can dent, crack, or bruise roofing materials. The average home insurance payout for wind and hail is $13,000.

- Fallen Trees or Limbs: Damage from a tree or large branch falling on your roof during a storm is generally covered.

- Fire and Lightning: Damage from fire or a lightning strike is almost always covered.

- Sudden Accidental Events: This broad category can include damage from the weight of snow and ice or a vehicle hitting your home.

Note that policies vary. Damage from rain is typically only covered if it’s the result of another covered event, like a hole created by hail. For help with storm-related issues, learn more about our storm damage roof repair services.

How to Spot Hail and Wind Damage Like a Pro

After a storm, damage isn’t always visible from the ground. Knowing what to look for is key.

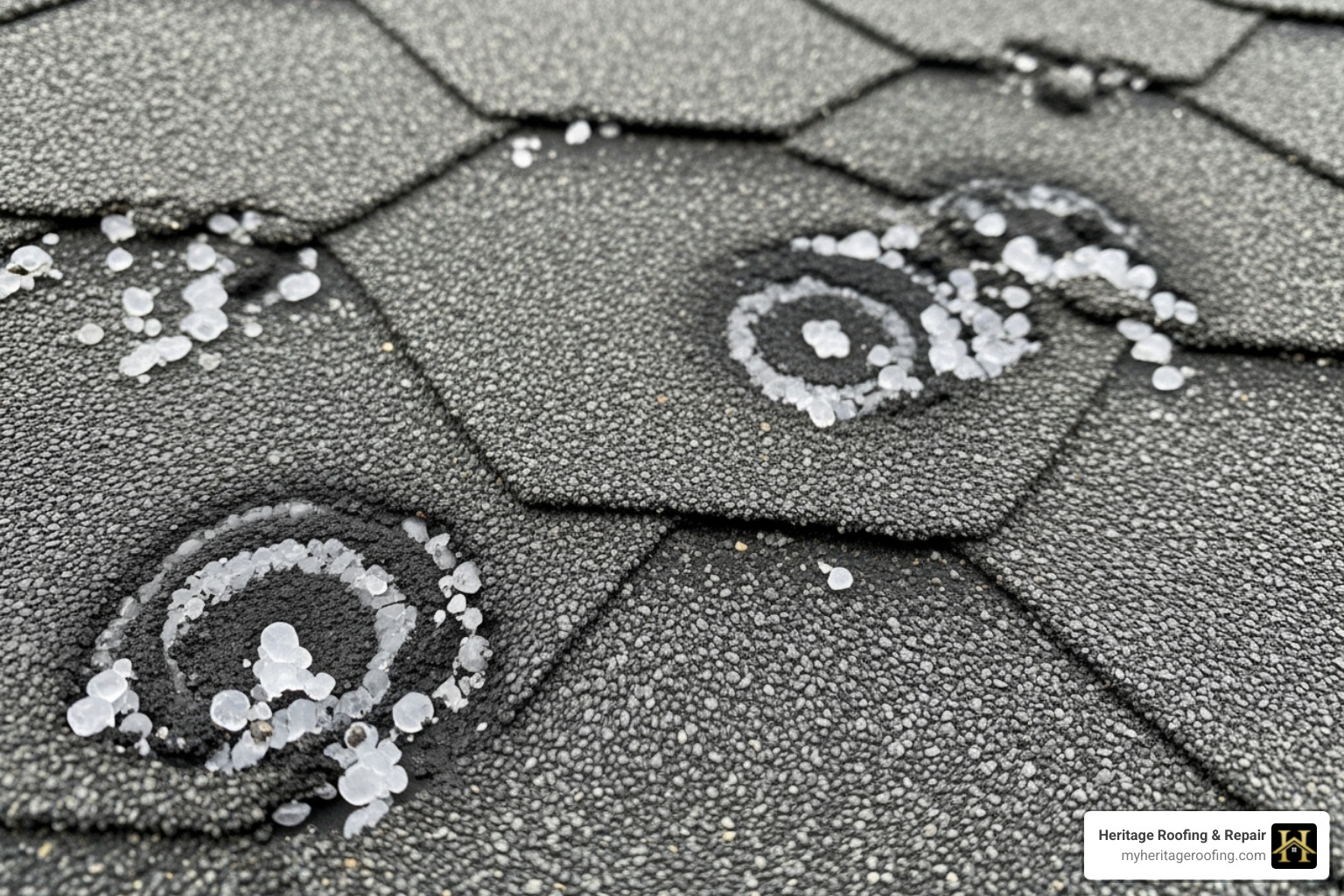

Signs of Hail Damage:

- Dents or Pockmarks: Look for circular indentations on asphalt shingles or visible dents on metal roofs.

- Bruising & Granule Loss: Hail can crush the shingle’s fiberglass mat, creating soft spots. This often dislodges the protective granules, leaving dark spots on the roof.

- Collateral Damage: Check for dents on gutters, siding, A/C units, or window frames. This supports your claim for roof damage.

Signs of Wind Damage:

- Missing or Creased Shingles: This is the most obvious sign. Look for entire shingles blown off or shingles that are lifted, curled, or have a crease line where the seal was broken.

- Damaged Gutters or Siding: High winds can bend or detach gutters and siding.

- Debris: An unusual amount of debris on your roof or in your yard can indicate a severe wind event.

If you see these signs, contact a professional roofer for a safe and thorough inspection.

ACV vs. RCV: The Policy Detail That Can Cost You Thousands

Understanding the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) is critical, as it directly impacts your payout. This is one of the most important details in your policy.

- Actual Cash Value (ACV): Pays for the depreciated value of your roof. If your 20-year roof is 10 years old, an ACV policy might only pay for half its replacement cost, leaving you with a large out-of-pocket expense.

- Replacement Cost Value (RCV): Pays the full cost to replace your roof with new, similar materials, without deducting for depreciation. You’ll typically receive an initial ACV payment, with the remaining amount (recoverable depreciation) paid after the work is complete.

Heres how it breaks down for a $20,000 roof that is 10 years old (50% depreciated):

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Payout Calculation | Replacement Cost – Depreciation | Full Replacement Cost |

| Example Payout | $20,000 – $10,000 (Depreciation) = $10,000 | $10,000 (Initial ACV) + $10,000 (Final) = $20,000 |

| Your Out-of-Pocket | High (You cover the $10,000 depreciation) | Low (Typically just your deductible) |

| Best For | Homeowners prioritizing lower premiums | Homeowners wanting full coverage without major expense |

Always review your policy to confirm which coverage you have. An RCV policy can save you thousands.

The Importance of Thorough Damage Documentation

Properly documenting damage is essential for a successful roofing insurance claim. You can never have too much proof.

- Photos and Videos: Take clear, high-resolution photos and videos of all damaged areas from multiple angles. Use your phone’s date and time stamp feature.

- Damage Log: Keep a written journal noting the date, time, and description of the damage you observed.

- Pre-Storm Photos: If you have them, photos of your roof before the storm provide a valuable “before and after” comparison.

- Save Receipts: Keep all receipts for temporary repairs, like tarping, as these may be reimbursable.

Store all documentation securely in the cloud or on an external drive. This evidence helps us build a strong case for your claim. For a professional assessment, schedule a detailed roof inspection with a reputable local contractor.

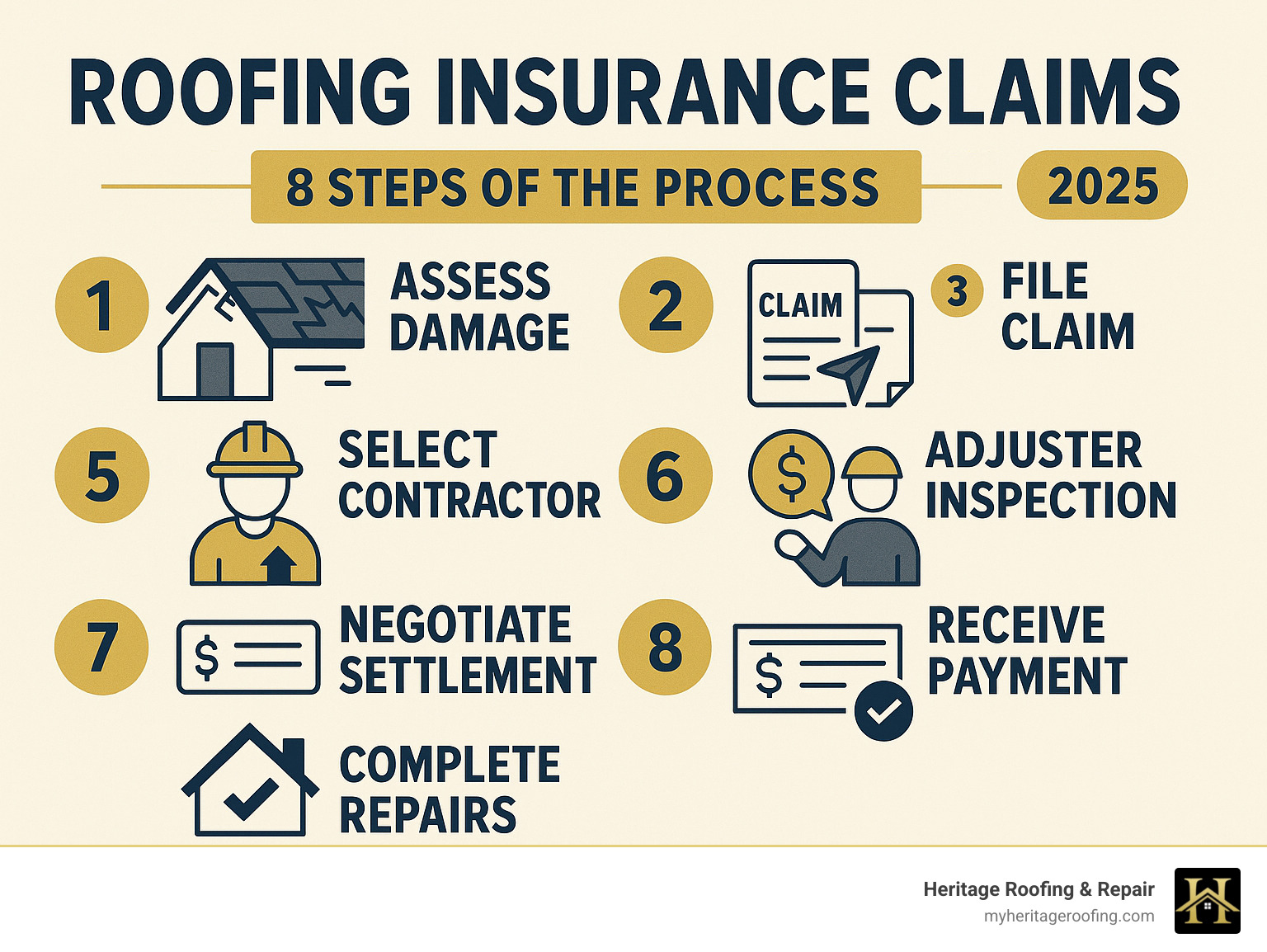

The Step-by-Step Guide to Filing Roofing Insurance Claims

Once you’ve confirmed damage and reviewed your policy, it’s time to initiate the claim. Following a structured process and staying organized are your best defenses against delays and disputes.

Step 1: Initial Contact and Filing Your Claim

File your claim as soon as possible. Most policies have a time limit, often one year from the date of the storm, but sometimes as short as 30-60 days. Delaying can risk denial. Contact your insurance agent or the company’s claims department online or by phone. Once you report the damage, you will be assigned a claim number—keep this number handy for all future communications. Be prepared to provide your policy number and a description of the damage, referencing the photos and notes you’ve already gathered. For more tips, Angi offers a helpful guide on How to Make an Insurance Claim for Roof Damage.

Step 2: The Insurance Adjuster’s Inspection

Your insurance company will assign an adjuster to inspect the damage and estimate the repair costs. The adjuster represents the insurance company, and their goal is to verify a covered loss. We strongly recommend having your trusted roofing contractor present during this inspection. A roofer acts as your advocate, pointing out subtle damage the adjuster might miss and ensuring the scope of work is complete and accurate. This collaboration helps prevent an initial estimate that is too low and sets the stage for a fair settlement.

Step 3: Reviewing the Estimate and Getting Paid

After the inspection, the adjuster will provide a detailed estimate. It’s common for this initial offer to be insufficient, often missing costs related to local building codes or specific materials. If the estimate is too low, your contractor will submit a “supplement” with documentation to justify the additional funds needed for a proper repair. We are experts at this process.

Once the scope is agreed upon, you’ll typically receive a first check for the Actual Cash Value (ACV) of the damage. If you have an RCV policy, a second check for the recoverable depreciation is issued after you submit the final invoice for the completed work. If you have a mortgage, the check may be co-payable to your lender, who will need to endorse it.

A detailed roof repair estimate should always include these essential items:

- Materials Breakdown: Specific types and quantities of all materials (shingles, underlayment, flashing, ice and water shield, ridge vents, etc.)

- Labor Charges: Detailed breakdown for tear-off, installation, and cleanup

- Building Permits: All required permits and associated fees

- Code Compliance: Details on meeting current building codes and any necessary upgrades

- Project Timeline: Clear start and completion dates with weather contingencies

- Payment Schedule: When payments are due and acceptable payment methods

- Warranty Information: Coverage details for both materials and workmanship

- Disposal Fees: Costs for proper disposal of old roofing materials

- Safety Equipment: Any necessary scaffolding or safety measures included

Choosing Your Advocate: Why a Reputable Contractor is Crucial

The most important partner you’ll have during this process is your roofing contractor. A good contractor is more than a laborer; they are your advocate, ensuring the insurance company’s assessment is accurate and that your roof is restored to its pre-storm condition.

How to Choose a Reputable Roofing Contractor for Insurance Claims

Selecting the right roofer is critical when dealing with an insurance claim. Look for a contractor who understands both the technical and administrative sides of the process.

- Local and Established: Choose a contractor with a physical office and a long-standing reputation in your community. A local company like ours, serving Northwest Arkansas for over 50 years, will be here to honor warranties.

- Licensed and Insured: This is non-negotiable. Verify they have general liability and workers’ compensation insurance to protect you from liability.

- Highly-Rated: Check their Better Business Bureau (BBB) rating and online reviews to gauge customer satisfaction.

- Certified and Experienced: Look for manufacturer certifications (e.g., GAF, Owens Corning) and specific experience with insurance claims. An experienced roofer knows how to document damage, write estimates using industry software like Xactimate, and negotiate effectively with adjusters.

At Heritage Roofing & Repair, we are experts in roofing insurance claims. For more advice, read our blog post on Tips for choosing a trustworthy roofing contractor.

Red Flags to Avoid: Spotting “Storm Chaser” Scams

After a major storm, out-of-state “storm chasers” often arrive, using high-pressure tactics to make a quick profit before disappearing. They frequently perform shoddy work and leave homeowners with no recourse.

Watch for these major red flags:

- High-Pressure Tactics: Pushing you to sign a contract on the spot.

- Offers to Pay Your Deductible: This is illegal and a clear sign of insurance fraud.

- Vague Contracts: A lack of detail on the scope of work, materials, or cost.

- No Local Presence: Out-of-state license plates and no local office or references.

- Demands for Full Payment Upfront: Reputable contractors have a structured payment schedule.

- No Proof of Insurance: If they can’t provide certificates, walk away.

Trust your gut. A legitimate contractor will be transparent and professional.

Your Local Roofing Partner in Berryville, AR

When you’re dealing with storm damage, you need a team you can trust. Heritage Roofing & Repair is proud to serve the Berryville community with honesty and integrity. We’ve been a part of this community for generations, and we treat every roof we work on as if it were our own. Our deep understanding of local building codes and insurance claim requirements ensures a smooth, efficient process for our neighbors.

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

(870) 654-1164

Denied or Underpaid? How to Overcome Claim Roadblocks

Even with careful preparation, you can face roadblocks like a denied claim or a low settlement offer. Understanding how to overcome these common challenges is key to getting the resolution you deserve.

What to Do If Your Roof Insurance Claim is Denied or Underpaid

Receiving a denial or a low offer is frustrating, but it’s often not the final word. Common reasons for denial include claims of poor maintenance, normal wear and tear, or insufficient documentation. If this happens, don’t give up.

Heres what to do:

- Request a Denial Letter: Ask the insurer for a formal letter explaining the exact reasons for their decision.

- Review Your Policy: Compare their reasoning against your policy’s language.

- Get a Second Opinion: Have a reputable roofer conduct a new inspection to provide a professional counter-assessment.

- Appeal the Decision: Formally appeal the decision with your new evidence and contractor’s report.

- Consider a Public Adjuster: A public adjuster works for you, not the insurance company, to negotiate a fair settlement. They work on a contingency basis, so they only get paid if you do.

Persistence is crucial. Many homeowners who appeal an initial decision with the right evidence and advocacy achieve a better outcome.

Will Filing a Claim Increase My Premiums?

This is a valid concern. The answer is: possibly, but not always for a single storm claim. Damage from natural disasters is often considered an “Act of God.” While your individual premium is less likely to rise from one such claim, your rates could increase if widespread storms cause a rise in claims across your region. However, if you file multiple claims in a short period, your insurer may see you as a higher risk.

When deciding whether to file, weigh the repair cost against your deductible. For minor damage slightly above your deductible, it might not be worth it. But for a major roof replacement costing thousands, the financial benefit of filing a claim almost always outweighs the risk of a potential premium increase. As the Texas Department of Insurance notes, protecting your home with a sound roof is a critical investment.

Preventative Maintenance to Avoid Future Issues

Insurance covers unexpected damage, not neglect. Regular maintenance extends your roof’s life and strengthens your position in future claims.

- Annual Inspections: Have a professional inspect your roof annually and after major storms.

- Keep it Clean: Regularly clean gutters and remove debris like leaves and branches from the roof surface.

- Trim Trees: Cut back overhanging branches to prevent damage and debris accumulation.

- Prompt Repairs: Address small issues like a loose shingle immediately before they become big problems.

Preventative care saves you money and headaches. Keep records of all maintenance to support any future claims.

Frequently Asked Questions about Roofing Insurance Claims

We get a lot of questions from homeowners about the insurance process. Here are some of the most common ones we hear:

How long do I have to file a roof claim after a storm?

Most policies require you to file within one year of the storm, but some have shorter deadlines (e.g., 180 days). It is critical to check your policy and file promptly. The sooner you act, the easier it is to prove the damage was caused by the storm, as waiting can allow damage to worsen.

Should I get multiple estimates for an insurance-paid roof replacement?

For an approved insurance claim, this is usually unnecessary. The insurance company sets the price using standardized software based on local market rates. Your goal isn’t to find the cheapest bid but to choose a high-quality contractor who will do the job correctly for the approved amount. A good roofer will work with the insurer’s estimate and supplement it if needed to cover the full scope of work.

Is it illegal for a roofer to cover my deductible?

Yes, absolutely. A roofer offering to waive or absorb your deductible is committing insurance fraud, which puts you at risk. The deductible is your legal responsibility as the policyholder. This offer is a major red flag indicating a dishonest contractor.

Conclusion: Take Control of Your Roof Claim with an Expert Partner

Navigating a roofing insurance claim can feel overwhelming, but it doesnt have to be. By understanding your policy, thoroughly documenting damage, and following a clear process, you can take control of the situation. The most critical decision youll make is choosing a trusted, local roofing contractor to act as your advocate. An experienced partner ensures the work is done right and that you receive the full compensation youre entitled to.

If your home has been affected by a storm, dont face the insurance process alone. The team at Heritage Roofing & Repair has decades of experience helping homeowners in Northwest Arkansas with their insurance claims. Contact us today for a free, no-obligation inspection and let us help you restore your peace of mind.