Why Finance a Roof Replacement? (The $20,000 Question)

Facing a roof replacement can feel overwhelming, especially when you see the price tag. It’s a critical investment in your home’s safety and value, but the high upfront cost is a major hurdle for many families. That’s where understanding your roof replacement financing options becomes a game-changer. For homeowners in Northwest Arkansas, knowing how to fund this essential project without draining your savings is key to peace of mind. As a company with deep roots in the community, Heritage Roofing & Repair—your trusted roofing contractor in Northwest Arkansas—has helped countless residents steer this process, ensuring they get a durable, high-quality roof without financial strain. This guide will walk you through the best financing choices to make your roof replacement affordable and manageable.

The reality is stark: a new roof is a significant expense. The average roof replacement cost typically falls between $8,000 and $25,000 in most areas, including right here in Arkansas. Factors like the size of your roof, the materials you choose, and the complexity of the job all play a role. When your roof starts leaking after a thunderstorm or sustains widespread damage from hail, waiting isn’t an option. Delaying necessary repairs can escalate quickly, leading to severe structural damage, pervasive mold growth that can affect your family’s health, and water damage that ruins insulation, ceilings, and walls—turning a manageable problem into a catastrophic and far more expensive ordeal.

But here’s the good news: financing allows you to protect your home immediately while preserving your cash flow. Furthermore, a new roof is one of the smartest investments you can make in your property. According to Remodeling Magazine’s 2023 Cost vs. Value Report, homeowners can recoup over 60% of the installation costs through increased home value. For homeowners in Berryville and Northwest Arkansas, combining professional roof replacement services with smart financing not only protects your investment but actively improves it.

As Rex Wisdom, owner of Heritage Roofing & Repair with over 50 years of family experience in the industry, I’ve helped countless homeowners steer roof replacement financing options to find solutions that fit their budgets and timelines. Our team regularly works with various lenders and financing partners to ensure our clients get the best possible terms for their roofing projects. We believe in making the best residential roof replacement accessible to every family who needs it.

The Urgent Need vs. The Budget

Imagine waking up to a dark water stain spreading across your ceiling during a heavy rainstorm. Or perhaps a recent hail storm has left your roof looking more like a golf ball than a protective barrier. These aren’t scenarios you can plan for, and they often come with a hefty price tag that most homeowners don’t have readily available. This is where financing shines. It bridges the gap between the urgent need for a safe, secure roof and your current budget. By converting a large, intimidating sum into predictable monthly payments, you can address emergency repairs, storm damage, or sudden leaks promptly. Acting fast prevents further, more costly structural damage and gives you invaluable peace of mind, knowing your most valuable asset is protected without draining your emergency savings.

When timing is critical, speed matters. Options like personal loans or contractor-arranged financing can deliver approvals in days—not weeks—so crews can get on your roof quickly. Pairing fast funding with a clear repayment plan keeps your project moving forward without forcing you to compromise on materials or workmanship.

Investing in Your Home’s Future Value

A new roof isn’t just a defensive measure; it’s a significant investment in your home’s future. A well-maintained, attractive roof instantly boosts curb appeal, making your home stand out in the neighborhood. Beyond aesthetics, modern roofing materials offer superior energy efficiency. For example, cool-roofing technology reflects more sunlight and absorbs less heat, which can significantly lower your air conditioning bills during hot Arkansas summers.

Perhaps most compelling is the direct return on investment (ROI). As mentioned, data from sources like Remodeling’s Cost vs. Value Report confirms that a new roof can provide a homeowner with a 60% ROI or more. This means financing a roof replacement isn’t just an expense; it’s a strategic financial move. It adds tangible value that you can recover when you sell your home, signaling to potential buyers that your property is well-cared-for and ready for decades of worry-free living.

Pro tip: If you’re planning to list your home within the next few years, consider how financing terms align with your selling timeline. A competitively priced loan with no prepayment penalty lets you enjoy the benefits now and pay off the balance at closing if you choose.

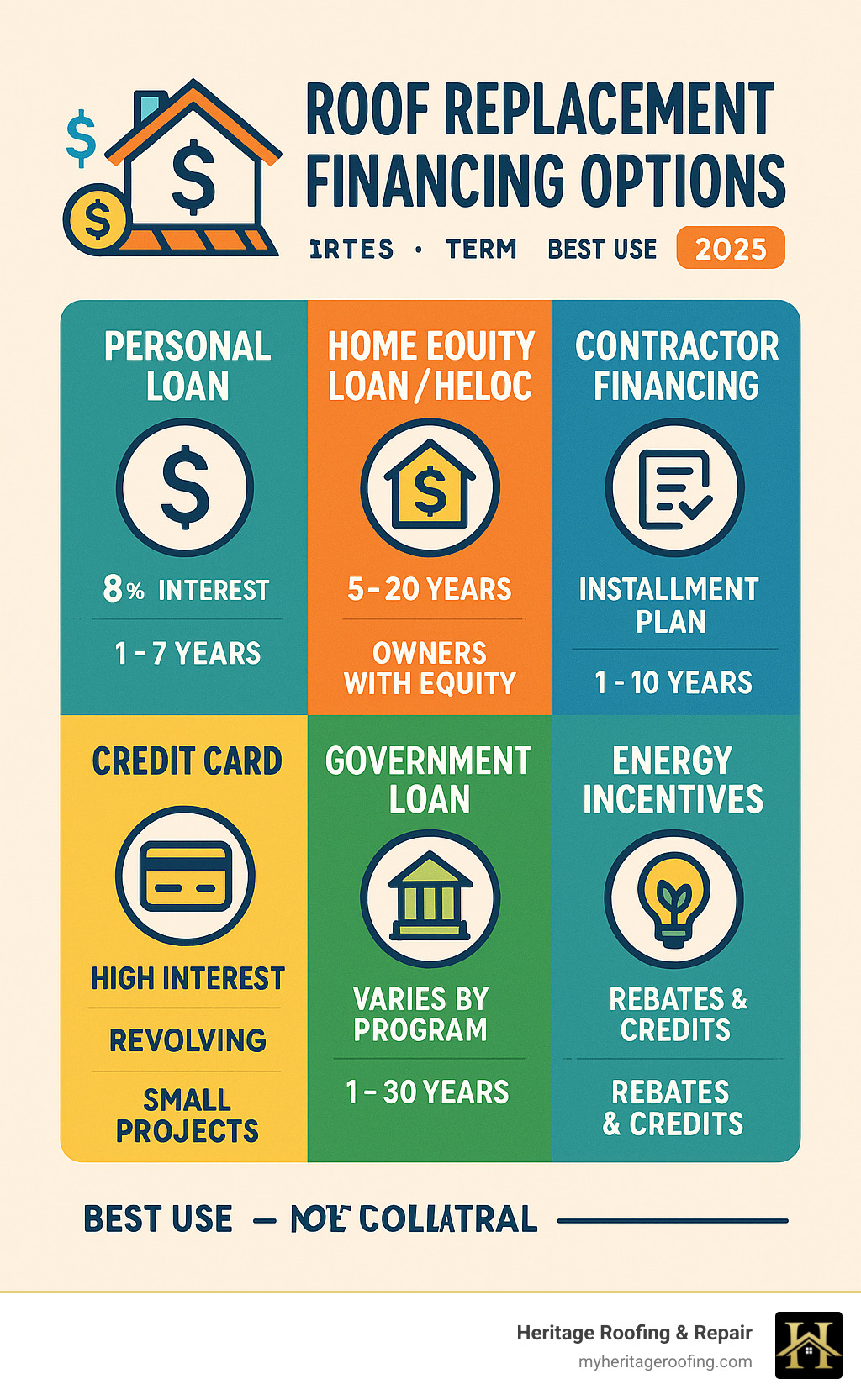

A Deep Dive into 7 Roof Replacement Financing Options

When it comes to roof replacement financing options, understanding the details of each choice can make the difference between financial stress and peace of mind. The right path depends entirely on your personal financial situation, including your credit score, the amount of equity you have in your home, and how quickly you need the project completed. Below is a comprehensive breakdown of the most common financing methods to help you compare them at a glance and decide which avenue is best for your family.

| Financing Option | Interest Rate (Typical Range) | Loan Term (Typical) | Best For | Key Consideration |

|---|---|---|---|---|

| 1. Personal Loans | 8% – 36% APR | 2 – 7 years | Homeowners with good-to-excellent credit who need fast funding without using their home as collateral. | Unsecured, so rates are higher than home equity loans. Approval and funding can happen in just a few business days. |

| 2. Home Equity Loan / HELOC | 6% – 12% APR (often variable for HELOCs) | 5 – 30 years | Homeowners with significant home equity looking for the lowest possible interest rates for a large project. | Your home is used as collateral, which adds risk. The application process is longer, similar to a mortgage. |

| 3. Contractor Financing | 5% – 25% APR (promotional 0% offers available) | 1 – 15 years | Homeowners who value convenience and a streamlined, one-stop-shop process managed by their roofer. | Rates may be higher than a bank loan, but promotional periods (e.g., 0% APR for 12 months) can be very attractive. |

| 4. Credit Cards | 18% – 29%+ APR | Revolving | Small repairs, covering a portion of the cost, or taking advantage of a 0% introductory APR offer. | Extremely high interest rates if the balance isn’t paid off quickly. Best used strategically for short-term financing. |

| 5. FHA Government Loans | Market Rates (set by lender) | Up to 20 years | Homeowners with lower credit scores or little-to-no home equity. | These are government-insured FHA Title I loans that have specific rules on how the funds can be used for home improvement. |

| 6. Energy-Efficiency Incentives | N/A (Cost Reduction) | N/A | Homeowners installing certified energy-efficient roofing materials (e.g., ENERGY STAR rated). | These are not loans but tax credits, grants, or rebates that lower the total project cost. Check resources like DSIRE for local programs. |

| 7. Retail Credit | 20% – 30%+ APR (deferred interest common) | 1 – 5 years | Financing materials purchased from a specific home improvement store (e.g., Home Depot, Lowe’s). | Often comes with “deferred interest” promotions that can be costly if the balance isn’t paid in full by the deadline. |

Each of these roof replacement financing options offers a unique blend of benefits and drawbacks. A personal loan provides speed, while a HELOC offers lower rates. Contractor financing delivers unparalleled convenience, and strategic use of credit cards or rebates can help manage costs. The key is to evaluate your financial health, get multiple quotes, and read all the terms and conditions before signing any agreement. By doing your homework, you can confidently choose a financing plan that makes your new roof a sound and stress-free investment.

How to match the option to your situation:

- Need the roof ASAP after a storm? Consider a personal loan or contractor financing for the fastest approvals.

- Planning premium materials and have strong equity? A home equity loan or HELOC can minimize interest cost over time.

- Lower credit or limited equity? Explore FHA Title I options and compare them to contractor programs.

- Targeting energy savings? Pair your financing with verified energy-efficient shingles and apply for local rebates.

Smart safeguards to protect your budget:

- Compare APR and total loan cost, not just the monthly payment.

- Ask about fees (origination, late fees) and whether there’s a prepayment penalty.

- Watch for deferred-interest promos; if the promo expires with a balance, back-interest can kick in.

- If you’re filing an insurance claim, remember financing can cover your deductible and any upgrades not covered by the policy.

Your Local Roofing Partner in Berryville, AR

For homeowners in the Berryville area, working with a trusted local expert simplifies the entire process—from inspection to navigating financing and insurance.

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

(870) 654-1164