Understanding Roof Damage for Insurance Claims

After a storm, the first question for many homeowners is, how much roof damage for insurance claim is enough? Insurers focus on functional damage that compromises your roof’s integrity, not just cosmetic issues. Navigating the complexities of a claim can be challenging, which is why partnering with a trusted Northwest Arkansas roofing company is a crucial first step.

This guide will walk you through identifying claim-worthy damage, understanding the adjuster’s process, and navigating your policy’s terms to determine if filing a claim is the right move. For personalized assistance with your roof and insurance claim, Heritage Roofing & Repair is here to help. Learn more about how we assist with roofing insurance claims on our dedicated service page.

Similar topics to how much roof damage for insurance claim:

- can i claim a roof leak on insurance

- homeowners insurance denied roof claim

- how to file roof replacement insurance claim with adjuster

What Constitutes ‘Claim-Worthy’ Roof Damage?

When your roof is damaged, it’s natural to wonder, “how much roof damage for insurance claim is really needed?” A valid claim is for damage that is sudden, accidental, and caused by a covered peril, like a severe storm. Homeowners insurance is not for general upkeep, so it won’t cover issues from old age, poor maintenance, or normal wear and tear. Insurers look for clear proof that a recent event has compromised your roof’s integrity and shortened its useful life.

Typical Signs of Hail Damage Adjusters Look For

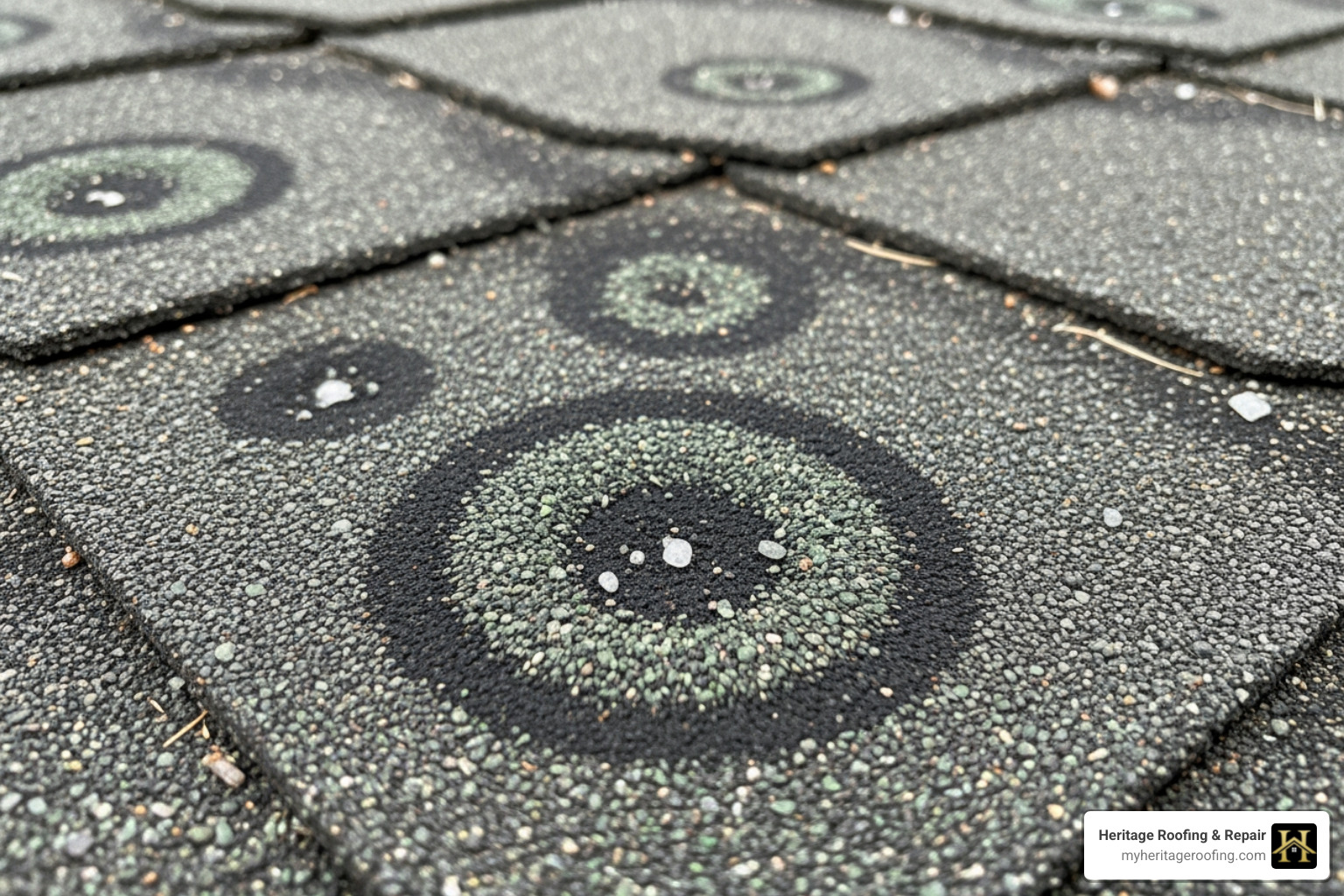

Hail damage is a frequent reason for roof insurance claims in Northwest Arkansas. Adjusters are trained to find impacts that genuinely damage shingles, not just cosmetic flaws. Generally, hail must be at least 1 inch in diameter (quarter-sized) to cause significant harm.

Key indicators of hail damage include:

- Dents and Bruises: Soft spots on asphalt shingles where the underlying mat has been damaged.

- Granule Loss: Hail can knock off protective granules, exposing the asphalt to UV rays and accelerating aging.

- Cracks: Severe hail can crack shingles, especially older, more brittle ones.

- Splatter Marks: Marks on roof vents or gutters that indicate the size and intensity of hailstones.

- Collateral Damage: Dents on gutters, siding, or A/C units suggest your roof likely has hail damage too.

Assessing Wind and Storm Damage

High winds from a big storm can cause obvious damage, like missing shingles, or more subtle issues that lead to future leaks. Adjusters look for shingles that are lifted, creased, or have broken seals.

Common indicators of wind damage include:

- Missing Shingles: The most obvious sign of a direct hit from strong winds.

- Lifted or Curled Shingles: Wind can get under shingles, breaking the watertight seal.

- Creased Shingles: Strong winds can bend shingles backward, leaving permanent creases that weaken them.

- Broken Seals: Wind can break the adhesive strips that bond shingles together, creating vulnerabilities.

- Debris Impact: Falling branches or other objects can puncture or tear roofing materials.

Damage Types Typically Excluded from Coverage

Your homeowners insurance policy is not a maintenance plan. Claims for damage from neglect or pre-existing issues are almost always denied.

Common exclusions include:

- Wear and Tear: Normal aging, fading, or gradual deterioration is not covered.

- Neglect or Poor Maintenance: Damage from uncleaned gutters or ignored minor issues may be denied. This often includes damage from rodents or birds.

- Age-Related Issues: While a storm can damage an old roof, the payout may be reduced due to its depreciated value.

- Mold and Rot: Mold or rot that develops slowly from an unrepaired leak is usually excluded.

- Rust: Rust on metal components indicates long-term exposure and lack of maintenance, which is not covered.

- Earthquakes and Floods: These perils require separate, specialized insurance policies.

How Insurance Companies Determine a Payout: The Adjuster’s Process

When you file a roof damage claim, an adjuster inspects your roof to decide how much roof damage for insurance claim warrants a payout. They document their findings and use specialized software like Xactimate—the industry standard—to estimate repair costs based on local material and labor rates.

The average national payout for wind and hail claims is around $12,913, but your settlement depends entirely on the adjuster’s assessment. Since initial estimates can sometimes be low, having a professional roofing contractor present during the inspection is valuable. They can point out damage the adjuster might miss and ensure a comprehensive evaluation.

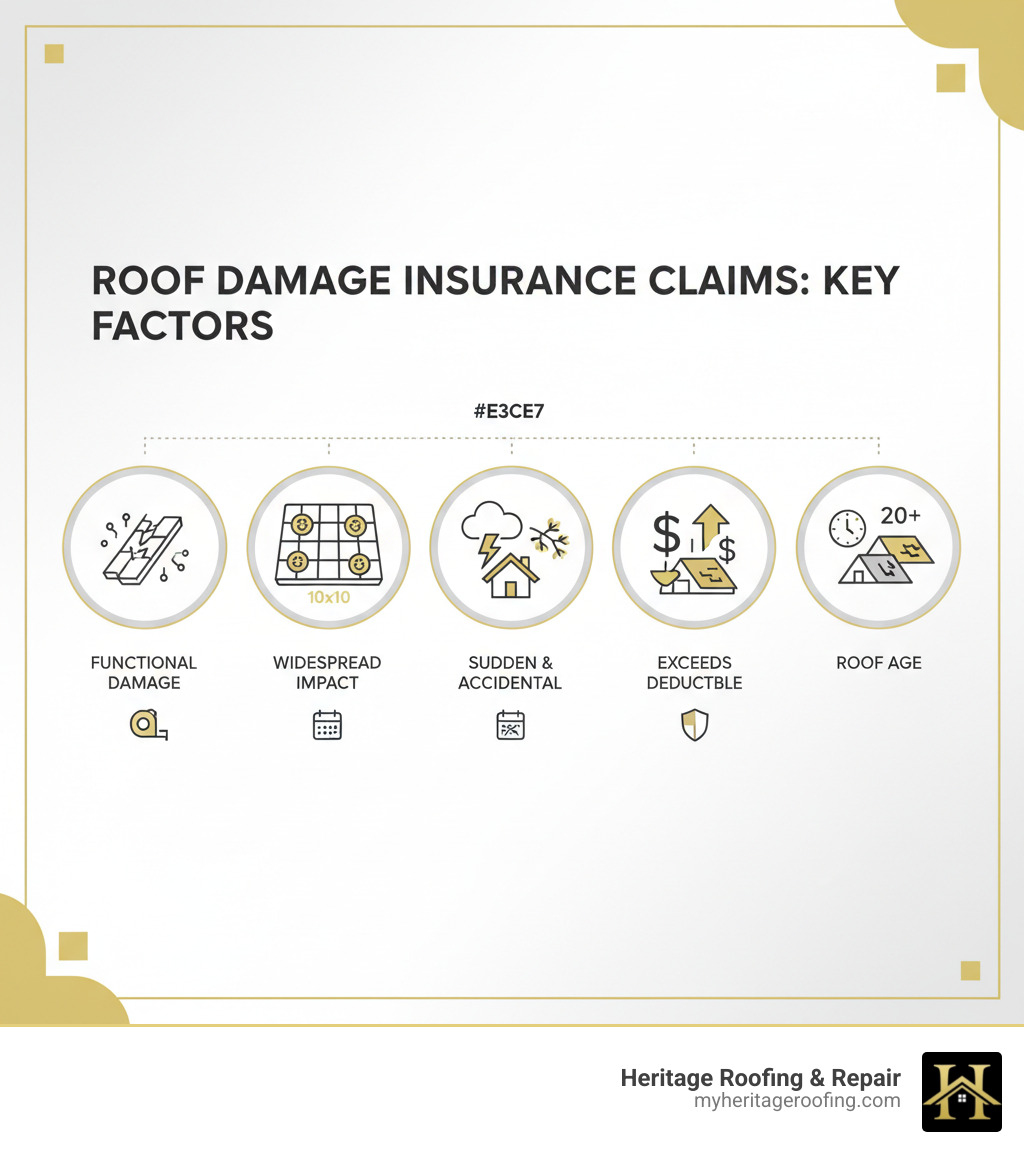

The Role of a ‘Test Square’ in Assessing Damage

For hail damage, adjusters use a standardized method called a “test square” to determine if the roof is a total loss. This is a 10-foot by 10-foot area marked on each slope of your roof.

Within each square, the adjuster counts verifiable hail impacts—bruises, cracks, or significant granule loss. If they find a sufficient number of hits, typically 7 to 10, they will often declare that entire slope damaged beyond repair. If multiple slopes meet this threshold, your whole roof is typically classified as a total loss, qualifying for a full replacement. If only one slope meets the threshold, the insurance company will likely only authorize replacing that slope.

How Your Roof’s Age and Condition Affect the Claim

Your roof’s age plays a massive role in your payout. If your roof is over 20 years old, many insurance companies will only offer its depreciated value, not the full replacement cost. For example, if your 20-year-old roof has an actual cash value (ACV) of $4,000 and your deductible is also $4,000, your claim payout could be $0.

Adjusters also scrutinize pre-existing conditions. Evidence of neglect, like clogged gutters or un-trimmed branches, may be used to argue that poor maintenance contributed to the damage, potentially reducing your payout or leading to a denial. Some states have regulations that can help, like Florida’s 25% Rule, which can mandate a full replacement if over 25% of a roof is damaged. Keeping records of maintenance and repairs can strengthen your position during a claim.

Understanding Your Policy: ACV vs. RCV and Your Deductible

Before filing a claim, you must understand your homeowners insurance policy. The payout you receive depends on your coverage type—Actual Cash Value (ACV) or Replacement Cost Value (RCV)—and your deductible. Knowing these terms helps you understand how much roof damage for insurance claim payouts you will actually receive. Reviewing your policy details can save you from major financial surprises.

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): What’s the Difference?

Whether your policy is ACV or RCV determines how much money you will get for a new roof.

- Actual Cash Value (ACV) policies pay the depreciated value of your roof. The insurer subtracts value for age and wear and tear. For an older roof, this can result in a much lower payout, leaving you to cover a large portion of the replacement cost.

- Replacement Cost Value (RCV) policies cover the full cost to replace your damaged roof with new materials of similar quality, without deducting for depreciation. You typically get an initial ACV payment, then a second payment for the remaining amount once repairs are complete.

For example, a $15,000 roof replacement on a 10-year-old roof with a $1,000 deductible:

- An ACV policy might determine the roof has depreciated by 50%, paying you only $6,500 ($7,500 ACV – $1,000 deductible). You would owe $8,500.

- An RCV policy would cover the full cost, paying you $14,000 ($15,000 replacement cost – $1,000 deductible).

For more details, you can refer to resources on home policies: replacement cost or actual cash value.

How Deductibles Impact Your Final Payout

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

- Fixed deductibles are a set dollar amount, like $1,000 or $2,000. If repairs cost $1,300 and your deductible is $1,000, insurance only pays $300. In this case, filing a claim may not be worth the potential premium increase.

- Percentage deductibles, common in storm-prone areas, are a percentage of your home’s insured value (e.g., 1% or 2%). A 1% deductible on a $300,000 home is $3,000, which can be a surprise to many homeowners.

If the repair cost is only slightly more than your deductible, filing a claim might not be financially wise. We can provide a free estimate to help you decide if filing makes sense.

How Much Roof Damage for Insurance Claim: A Step-by-Step Filing Guide

Filing an insurance claim can be a smooth process with proper organization and professional guidance. Following these steps helps ensure you receive a fair settlement that covers your damages.

Step 1: Initial Assessment and Documentation

Once a storm passes and it is safe, document everything. Take clear photos and videos of your roof from the ground, as well as your gutters, siding, and any other affected property. Note the date of the storm. If you see an active leak, make temporary repairs, like placing a tarp over the area, to prevent further water damage. Your policy requires you to mitigate further damage. Keep all receipts for temporary repair materials, as these costs are often reimbursable.

Step 2: Hiring a Professional and Filing the Claim

Before calling your insurer, have a qualified roof inspector provide an independent assessment and detailed estimate. This gives you a baseline for what repairs should cost. For homeowners in Northwest Arkansas, partnering with local roofing experts in Berryville, AR provides you with a knowledgeable advocate. We can accurately assess your damage and advise if how much roof damage for insurance claim purposes truly warrants filing. Once you have a professional assessment, contact your insurance company to file the claim and get a claim number for all future communications.

Step 3: The Adjuster Meeting and Reviewing the Settlement

Your insurer will schedule an adjuster to inspect the damage. We strongly recommend having your roofing contractor present for this critical meeting. An adjuster works for the insurance company, while your contractor works for you. Our team at Heritage Roofing & Repair will walk the roof with the adjuster, pointing out every impact and compromised area. We are familiar with the Xactimate software adjusters use, allowing us to advocate effectively for you.

After the inspection, you will receive a settlement offer. Review it carefully with your contractor. If the offer seems too low—which is common—your contractor can help you file a supplemental claim with additional evidence and more detailed estimates to negotiate a fair settlement.

Frequently Asked Questions About Roof Damage Claims

Will filing a roof damage claim raise my insurance premium?

A single claim for storm damage, considered an “act of God,” is less likely to raise your premium than other types of claims. Insurers are more concerned with claim frequency. Filing multiple claims in a short period (3 to 5 years) is a red flag that can lead to higher premiums or even non-renewal of your policy. The key is to use your insurance for its intended purpose: significant, unexpected damage.

Get Expert Help With Your Roof Insurance Claim in Northwest Arkansas

Dealing with roof damage and insurance claims is complex. It requires careful documentation, a deep understanding of your policy, and knowing how to negotiate with adjusters. You don’t want to leave your settlement to chance. Working with an experienced roofing contractor who specializes in claims is the best way to ensure your home is repaired correctly and you receive the fair compensation you deserve.

For over 50 years, our family at Heritage Roofing & Repair has been helping homeowners in Northwest Arkansas. We provide honest assessments and quality craftsmanship to restore your peace of mind.

Heritage Roofing & Repair

3458 Arkansas State Hwy 221, Berryville, AR 72616

(870) 654-1164

Has your roof taken a hit from a recent storm? Don’t stress. We offer a free, no-obligation inspection. Let us guide you through the process and help you navigate your roofing insurance claim with complete confidence.